CHECK TO SEE IF YOUR BUSINESS IS ELIGIBLE TO CLAIM R&D TAX INCENTIVES FROM HMRC

- No Win, No Fee

- HMRC Authorised Agent

- £91,111 Average Claim

- £120m claimed each year

- Payment within 28 working days from acceptance

- Defence Enquiry Team

We have helped hundreds of companies claim back thousands for their business

£120,000,000

What is the HMRC’s R&D Tax Incentive Scheme?

Research & Development Tax Credits are a UK Government incentive designed to boost innovation across multiple industries. This is an opportunity for you to reduce your corporation tax bill or receive a refund from HMRC based upon the working hours your business dedicates to research & development.

It's one of the UK’s top incentives for encouraging investment in Research & Development. Using the latest industry technology and in-house experts, the average R&D Tax Credit claim made through Oper Business Solutions in 2022 was £91,111.

The total amount of R&D Tax Incentives paid out last year was £7.4 billion.

HMRC confirms how the largest ever budget, £39.8 billion for R&D will be allocated to Small and Medium Sized companies.

Source: GOV.UK

How can we help you with your claim?

Some businesses use their accountant to submit an R&D tax credit claim, however, it can be complicated, and accountants often miss claimable expenses. Our team of R&D specialists and in-house accountants, ensure that the maximum possible amount is claimed for your research and development project.

We know what HM Revenue and Customs are looking for, so we can ensure your claim is submitted accurately and successfully. We make the claiming process streamlined and allow you to focus on the day-to-day running of your business.

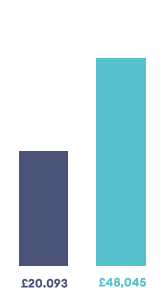

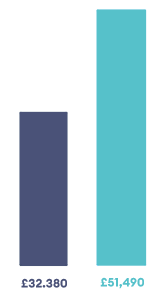

How we compare to other advisers and accountants

CONSTRUCTION

ENGINEERING

SOLAR & RENEWABLES

Have you conducted research to complete a project within your business?

We guide our clients step-by-step through the process to simplify the process, eligibility and maximise the claim.

Only 5% of eligible businesses claim their credits

you could be conducting R&D without knowing it and be owed thousands from HMRCR&D Claim Process Simplified in 4 Steps

1. Eligibility Call

Our in-house experts get to know your business to start identifying qualifying projects under the HMRC's R&D Tax Credit Scheme.

2. Estimate & Technical Review

Our R&D advisers analyse your last year or two years of full accounts to identify qualifying costs and give you an estimate of how much you can claim via the Government Incentive. One of our analysts will review your technical information to ensure it meets the HMRC’s complex guidelines.

3. R&D Claim Report

After an R&D consultation with one of our industry experts, we will produce a technical and financial report outlining the projects that fall under the HMRC guidelines.

We simplify and maximise the tax claim process by committing to completing the claim within 3-5 working days after receiving the necessary information from you and take care of the submission to HMRC using Authorised Agents.

4. Receive Tax Incentive from HMRC

Your Tax Incentive will be delivered as Cash or reduce/wipe any liabilities with HMRC such as Corporation Tax or PAYE.

Successful Claims

“I recently used Oper for my R&D claim after being made aware that I could claim for this. From point of contact with Joe Beck it was apparent that he knew what he was doing, had similar background and knowledge of the industry, I knew I was in reliable hands. All through the process it was made simple with his guidance and work he put in. Flawless experience and I’m a satisfied client and business. Thank you, 5 stars from me.”

Scott Duncan - Managing Director

Claim Value: £33,331

“Oper dealt with R&D our claim request swiftly, excellent service and the process was simple from getting the estimate to receiving our payment from HMRC. I would recommend and use again.”

William Channing - Managing Director

Claim Value: £142,094

.png?width=250&height=62&name=home-logo%20(3).png)

“Very clear on everything. First class service and very detailed on the whole service. Discussions held were very clear and flexible in the information”

Dave Stones – Managing Director

Claim Value: £39,557

TAKE OUR QUICK ONLINE ELIGIBILITY TEST, TODAY.

Using industry experts and the latest technology we simplify the process of finding what innovation funding options are available to you and maximise your claim value.

Research & Development Tax Credits are a UK Government Incentive scheme that rewards companies of all sizes and sectors that invest in their business.

95% of UK businesses are eligible to claim and you could be owed thousands from HMRC.

TAKE OUR ELIGIBILITY TEST...

- It takes less than 3 minutes to complete

- We'll tell you if you your eligible to make a claim under the HMRC's complex rules

- We can provide you an estimate using your expenditure breakdown

FAQ's

What are R&D Tax Credits?

Research & Development Tax Credits are a UK Government incentive designed to boost innovation across multiple industries. This is an opportunity for you to reduce your corporation tax bill or receive a refund from HMRC based on the working hours your business dedicates to research & development.

Can HMRC inquire about the claim?

This is a statutory tax relief and like all Government Incentive Schemes, the HMRC has a process of checking claims. As long as the claim has been made correctly and the relevant supporting information has been submitted, this would satisfy their compliance checks. HMRC support this relief and want more qualifying companies to claim. Inquiries into R&D tax credits are confined to looking at the claim rather than being extended to other areas of the company. We have a dedicated Defense Inquiry Team should HMRC inquire into any R&D projects

Can I claim R&D Tax Credits even if I'm a loss-making company?

Yes. The Small and Medium Sized Enterprise (SME) and RDEC Government Incentive schemes are designed to reward research and development activity by providing either relief on Corporation Tax, or cash incentive even if the business is loss-making.

How do I know we are eligible for R&D Tax Credits?

Due to the wide scope of R&D, over 85% of UK businesses are eligible for the Government scheme. If your business is trying to resolve project or business uncertainties with some level of risk, you are carrying out R&D. It does not matter which sector your business is in.

How much can I claim back?

The Tax Relief depends on the size of the company If you are a Small or Medium Sized Business (less than 500 employees or less than £100m turnover) you can claim up to 33% of your total R&D costs. For example, a project costing £250,00 even if wasn't successful, would be eligible to claim a sum of around £82,600.

Why has my accountant not advised me to do this yet?

Identifying R&D is a very niche service. Your accountant would have heard of R&D but may not specialise in R&D Tax Credits, and probably does not know how your business could be eligible. We work directly alongside over 75 chartered accountants across the UK and add value to their clients by providing expert R&D advice and ensuring all claims qualify under the guidelines.

Technical Expertise

Our team of R&D tax specialists, engineers, and chartered accountants have over 50 years of combined experience in maximising R&D Tax Credit claims.

HMRC Authorised Agent

We are in direct contact with HMRC to monitor changes within R&D legislation, and ensure your R&D claim adheres to new guidelines.

Proven Success

Our 100% success rate and no-win, no-fee model aligns our success with our customers.

.png?width=738&height=256&name=image%20(2).png)